Home » Uncategorized

Category Archives: Uncategorized

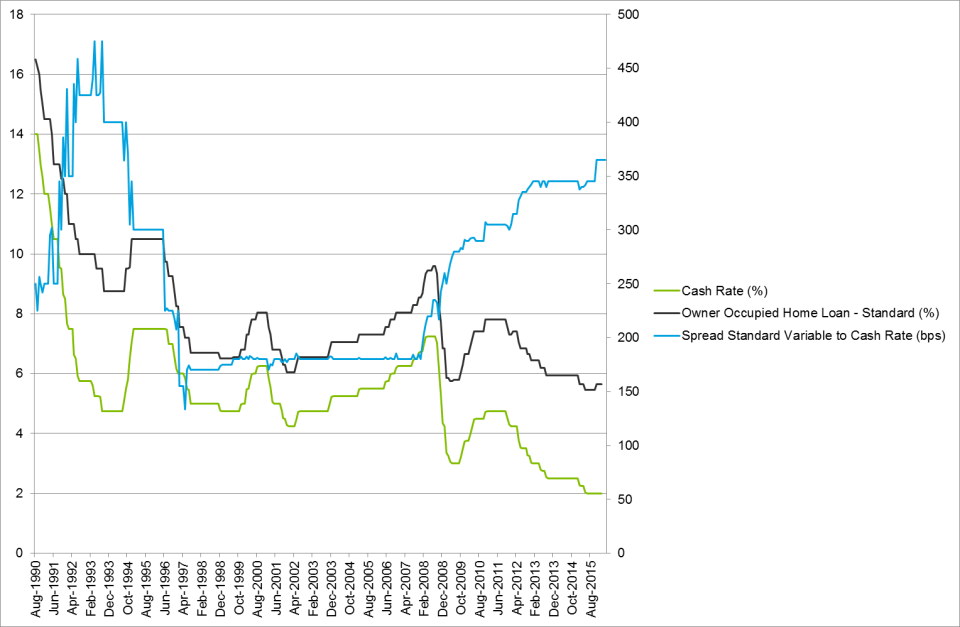

Trends in Australian home loan interest rates

The reserve bank of Australia’s decision to cut interest by 0.25% in May brings the cash rate to an all-time low. Three of the Big 4 followed by cutting their standard variable rate (SVR) by 0.25%. Only ANZ passed on 0.19% citing higher funding costs.

The RBA publishes a range of interest rate statistics including the mortgage standard variable rate and discounted mortgage rate, by both for major lenders and regional lenders. Here are some observations from a quick analysis of the RBA interest rate data.

For a number of years from the late 1990s to just before the GFC, banks moved their head line standard variable rate (SVR) lock step with the RBA cash rate. Following the GFC, banks did not pass on all the decreases to the cash rate as their funding spreads widened. The chart shows that the gap between the cash rate and the headline standard variable rate increased from around 175bps to over 350bps, particularly from around the GFC. With the banks following the RBA’s May lead, the headline SVR is also at its lowest.

Showing the headline standard variable rate however does not show the full picture. Some borrowers do not pay the full standard variable rate. For example simply taking up one of the banking packages e.g. CBA’s Wealth Package, will give a borrower a reasonable discount (around 0.7%).

The RBA also publishes a series of discounted variable rates offered. The chart below shows the discounted variable rate on owner occupied loans.

Since 2008, the level of discounts offered by banks to mortgage clients have increased by around 20bps. One factor could be selective pricing based on risk, rather than on overall reduction in the headline SVR. However even spread on the discounted SVR over the cash rate has increased significantly, despite accounting for a greater level of discounting.

At least over the past 18 months, the NIM for most banks has been steady. I have had a look at the net interest margin of two big 4 banks (ANZ, CBA) and two majors (Suncorp, and Adelaide Bendigo) from their annual reports. ANZ did recently show a 3bps reduction in their NIM. Interestingly Westpac who also reported half year results recently showed a 3 bps increase in NIM, through better pricing on customer deposits.

At least for the time being it seems like the banks have been able to pass on lower interest rates while more or less maintaining margins. For home owners, lower interest rates are bonus. Whether the lower interest rates have the RBAs’ desired effect remains to be seen.

Source of data:

Stress testing and its Cold War genesis

The role of the regulator and risk culture

Recently Paul Fisher of the PRA gave a speech titled “Regulation and future of the insurance industry“. In it he says:

“Solvency II will introduce an enhanced system of governance standards – promoting the embedding of a strong risk culture, demonstrable within the day-to-day operations of insurers.”

Risk culture is big in risk management now. Prudential regulations started off being directive based, then evolved to principles based regulation. Post GFC we have beyond principles to risk culture. While companies and consultants talk about it, it is an ethereal concept.

A system of governance standards is certainly very useful as it gives a common set of principles for risk processes, policies and reporting that should exist. Rules and limits are also useful where management have requirements that are NOT subject to personal judgement. But can you “implement” risk culture?

To me risk culture exists where the organisation and people value and exercise traits such as prudence, inquiry, transparency and critical thinking. Risk culture makes standards effective. Sure, standards can help with risk culture by requiring that people do things like getting models reviewed and approved. However if people do these things only because of standards then the standards haven’t really created good risk culture…